Agents for Financial Services

AI agents seamlessly integrated with existing systems, automating onboarding, compliance, and ongoing advice workflows.

Our SolutionsAI agents seamlessly integrated with existing systems, automating onboarding, compliance, and ongoing advice workflows.

Our SolutionsAI-Powered Solutions to Improve the Financial Advice Workflow

Client onboarding and meeting preparation

Transform First Meetings from Discovery Interrogations to Strategic Conversations

Transform First Meetings from Discovery Interrogations to Strategic Conversations

Streamlined annual review process through digital engagement

Automated client research, portfolio analysis, and meeting preparation

Real-time meeting support and capture

Mobile-first meeting management and client interaction platform

Comprehensive advisor portal for client management

Complete conversation capture and automated CRM extraction

Compliance and automated documentation

Automated post-meeting documentation with 57-point compliance validation

Automated post-meeting documentation with 57-point compliance validation

Automated drawdown and income planning calculations

AI-generated meeting summaries and action items

Pipeline of Agents and Future Propositions

Real-time BA1159 compliance validation with 57 regulatory checkpoints

AI-powered recommendation generation and strategy optimization

Intelligent automated letter generation and report creation

Automated client service and engagement management

Intelligent product recommendation and suitability analysis

Enhanced support and protection for vulnerable clients

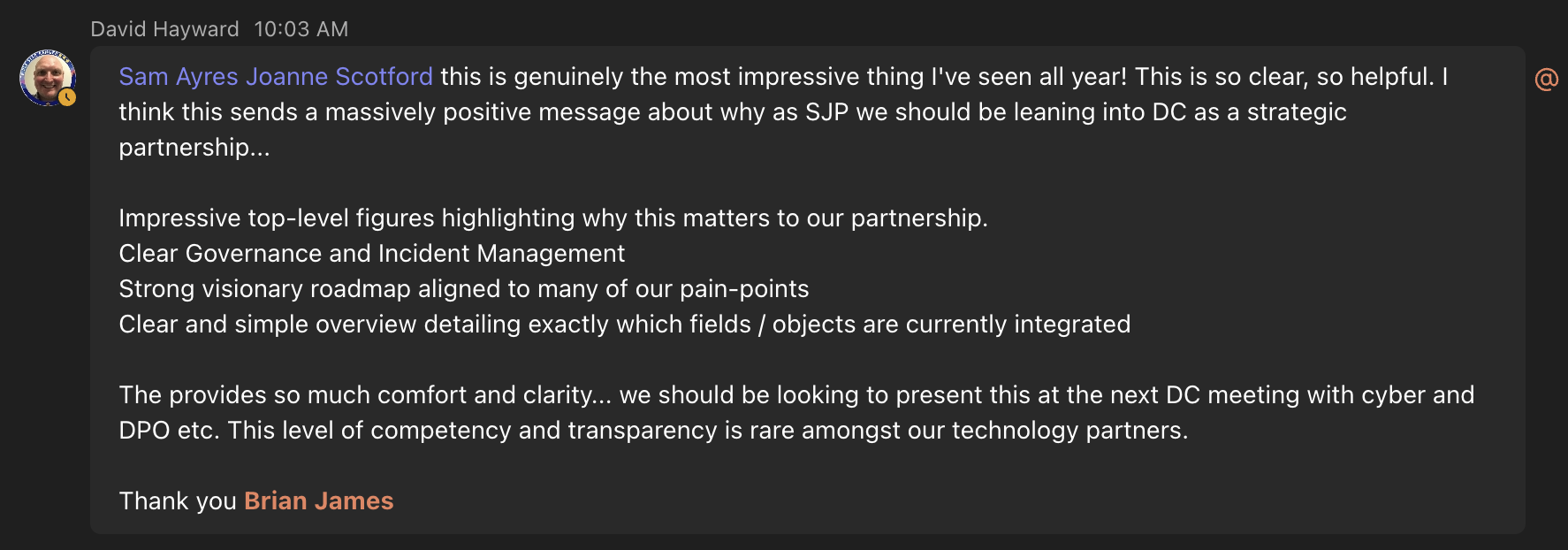

Positioning for strategic alignment within SJP's Technology Strategy (Unsolicited feedback)

Significant upside potential beyond base case projections

Automated meeting transcription, CRM population, and compliance validation. Built and ready—awaiting SJP regulatory approval.

Price increase from £8 to £10-11 per client per month, justified by 4 new AI agents launching (Meeting Prep, Compliance, Documentation, Advice Guidance).

Strategic investment or acquisition by St. James's Place. Natural acquirer given embedded position in advisor workflow across 1,312 practices.

Bridge to profitability in 6-9 months with £150K capital

The Problem: 3 hours of manual calculations per client generating zero margin

Our Solution: 20-30 minutes automated (85% time savings)

Market Position:

£150K bridge capital allocation to operational profitability

Three scenarios: Base Case, Conservative, and Optimistic

Transitioning from product development to optimized operations

SJP practices currently pay 12 months upfront for subscriptions via annualization. This creates a major cash flow event when renewals occur.